There is an undeniable weight of anxiety and fear that lives in the shadow of a catastrophic hail storm. These are the top concerns Austin vehicle owners have mentioned when it comes to filing a hail damage claim and whether it is worth it.

Fear of a Total Loss From Hail Damage

We love our cars. We do our due diligence when seeking out the ‘perfect’ car to mirror our lifestyles. This fear rings very true for later-model vehicle owners.

For example, you want the best value for your money when purchasing a used vehicle. You know you could run down to your local dealership and purchase a brand new model but you are more than fine with a gently used quality vehicle. Therefore, you do your research and track down a car, truck, or SUV that has better-than-average ratings, good to great miles-per-gallon, and retains its resale value. After you find it, you purchase it and protect it with a comprehensive insurance policy. You are more than satisfied with your new-to-you vehicle and then it happens.

It hails and you might start praying. After the storm, you check for hail damage and sure enough, every panel seems to have damage. Now what? As most used car owners know, the value of their vehicle is more pride than monetary resale value.

The Dreaded ‘Total Loss’ Verdict

The dreaded ‘total loss’ phrase creeps into your mind. If the insurance company totals it, you still have a loan to pay off. You know that replacing it will be nearly impossible. Now you start questioning whether filing a hail damage claim is even worth it. This is a tough scenario to swallow.

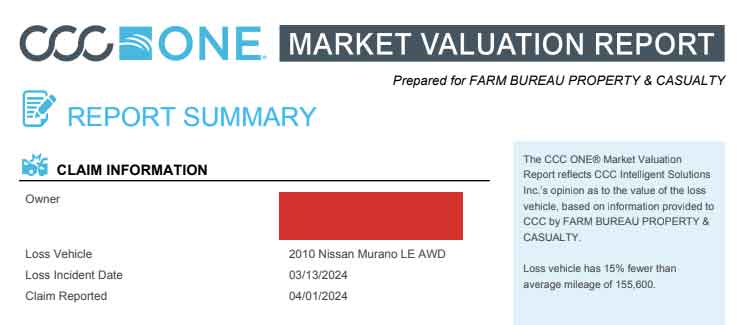

The vehicle was purchased for $10k, and you have $3k left to pay on it. The insurance adjuster comes out and, unfortunately, calls it a ‘total loss.’ The cost to repair the hail damage exceeds the Kelly Blue Book value of the car after considering depreciation. A few days later, you get a settlement offer plus a buy-back option.

Option 1

Filing a Hail Damage Claim on Your Vehicle

- Settlement Offer: The car’s pre-loss value is $8,500, and minus your $500 deductible, you are left with $8k. You pay the balance on the loan. You are now down to $5k to purchase another vehicle, but now, you are $1.5k in the hole.

- Buy-Back Option: Your insurance company offers to let you keep the vehicle for $3.5k. After the $8.5K minus $3.5K minus the $500 deductible, you keep the car plus they write you a check for $4.5k. You pay off the remaining $3k owed to the bank, and you are left with $1.5k and the hail-damaged vehicle that now has a salvage title. You can’t purchase comprehensive coverage on a salvage-titled vehicle.

Option 2

Not Filing, Keeping Vehicle With Hail Damage

If you decide to skip filing a claim altogether, consider the following:

If you have an outstanding loan on the vehicle or it is a leased or rented car, you have a legal obligation to file a claim for hail damage in Austin.

If you own the title on the vehicle, it is up to you to do whatever is right for you. If you do have full coverage, you are paying for a service for events such as hail damage or any other act of nature that might have damaged your car. Filing a hail damage claim is your right and, in many cases, your best option. We will outline why in the next section.

Risks of Keeping Your Vehicle With Hail Damage

- Resale value. If you plan on keeping the vehicle until it’s no longer mechanically sound and don’t mind the aesthetic of hail damage, this is your best bet. If you think you might want to sell the vehicle at a later date, expect to sell it cheap.

- Future damage. This might not be a scenario you have considered but let’s say you get rear-ended. Hypothetically, you’ve just had it, changed your mind, and decided to file a hail damage claim, after all. An adjuster comes out to assess the damage. They tell you that the damage caused by the hail could have been repaired, and the vehicle wouldn’t have been considered a total loss, but now, with the additional damage, it is a total loss.

DIY Car Hail Damage Inspection

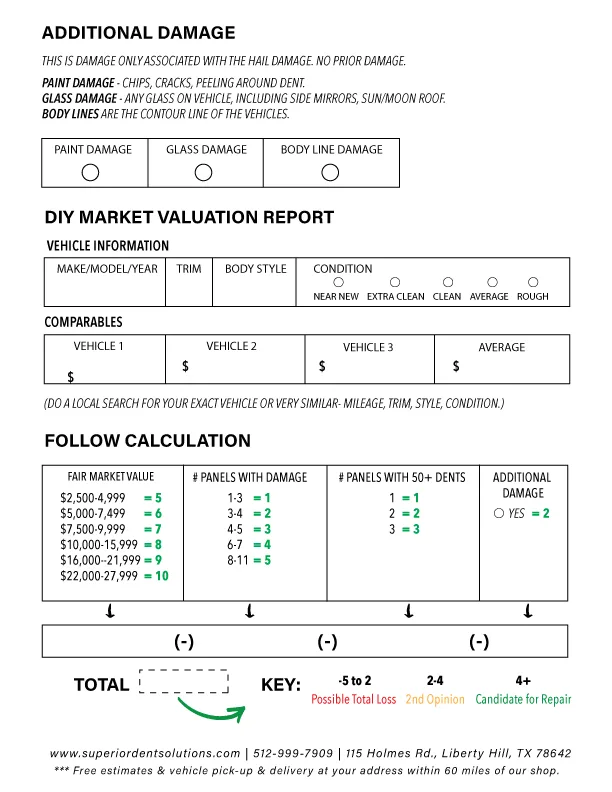

This is something you can easily do at home to get a pretty good idea of whether your vehicle has a pretty good likelihood of being deemed a total loss as a result of hail damage.

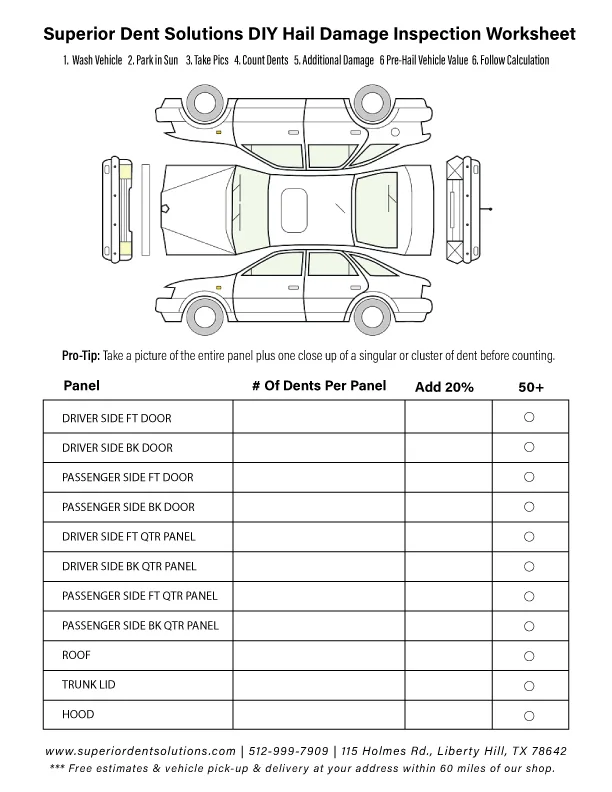

Do a quick wash of your vehicle. Move the vehicle into the sunlight. Look at every panel and count the number of dents you can see. Now add 20% to that number. If you see damage, we can almost guarantee there are some small dents that aren’t easily visible without proper PDR LED lighting. Do this for every panel.

You can download the DIY Hail Damage Inspection Worksheet PG 1 | PG 2 to make it easier.

Download FREE!

The Easy Solution

Austin Auto Hail Damage Inspections are FREE

…and without obligation. If you aren’t sure about your next steps and need some more information, consider calling Superior Dent Solutions for a free inspection at 512-999-7909. If you live in Austin or within 60 miles of our shop in Liberty Hill, we can come to you. We can pretty quickly determine if the hail damage on your vehicle is repairable or a ‘total loss’ if you decide to file a claim. We can also offer solutions and additional options.

Superior Dent Solutions has been repairing hail damage since 2016, and 95% of the vehicles come into our shop for repairs.

Where Would You Like Your Inspection?

Call Superior Dent Solutions today at 512-999-7909 or click on the links below to schedule your free 15-minute hail damage inspection.